Learn about our mission, donor impact, and history

Mission

Our mission is to increase charitable giving in the U.S. We do this by providing a tax-smart and simple giving solution of a donor-advised fund (DAF) account and related philanthropic tools and guidance that empower donors to incorporate planning into their everyday lives.

Donor impact

Since our founding in 1999 as an independent 501(c)(3) public charity, DAFgiving360™ donors have granted over $44 billion to more than 280,000 charities. You can learn more about this philanthropic impact in our Giving Report.

Donor satisfaction scores

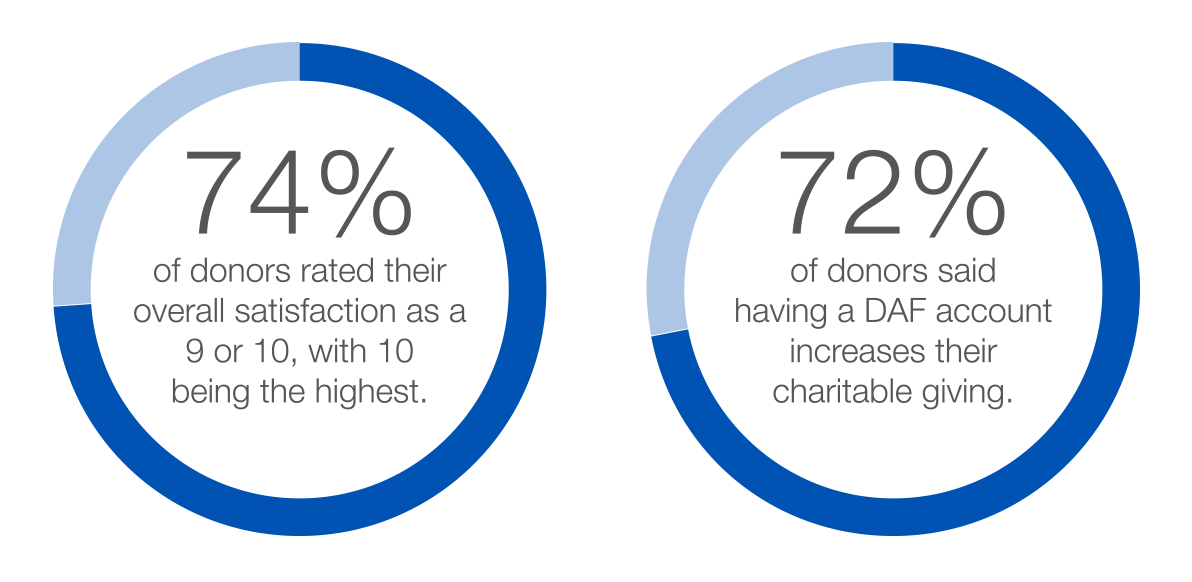

DAFgiving360 is grateful for the opportunity to support the philanthropic goals of our donors. They communicated their satisfaction with DAFgiving360 in recent surveys.*

-

Surveys were conducted in January 2025

History

-

1999

1999: Founded by Charles Schwab

Chuck establishes a national donor-advised fund to offer clients a better way to give to charities. He believes clients can maximize their charitable impact if they approach giving in the strategic way they approach investing and saving. -

2003

2000: Pioneered professionally managed accounts

We are the first national donor-advised fund to introduce this account type. The accounts allow donors to have their investment advisors build and manage investment portfolios for the charitable assets contributed to their accounts. -

2004

Accepted additional non-cash asset types for account contributions

The list of acceptable contributions is expanded beyond publicly traded securities, as we recognize the diversity of non-cash assets donors hold in investment portfolios, own in collections, and receive through inheritances. -

2009

2005: Added more investment pools for core accounts

We offer donors new choices for investing core account assets, including low-cost index and actively managed options from leading fund companies. Donors are investing with the objective of having more to grant to charities. -

2011

2010: Created the Legacy Program

Donors have a third succession plan option for their accounts. The program allows a donor to recommend charities for receiving recurring grants over a specific number of years after the donor’s life. -

2013

Established the Direct Global Giving Program for international granting

Responding to donors who wish to provide support outside the United States, we launch direct granting to international charities and become the first national donor-advised fund to collaborate with NGOsource on this service. -

2014

Enabled granting from phones and tablets

Donor-advised fund accounts are added to the Schwab mobile app, making it convenient for donors to recommend grants to charities when they are not at a computer. -

2015

2015: Enhanced international granting with two additional options

Options are added for donors supporting causes outside the United States: grants to U.S. charities doing international work, and grants to intermediaries that manage grants to international charities. -

2020

2020: Expanded socially responsible investment (SRI) options and eliminated $5,000 minimum contribution

A third SRI pool is added for core accounts, offering another way to invest assets based on environmental, social, and governance (ESG) principles. The $5,000 minimum initial contribution and $500 minimum subsequent contribution are also eliminated. -

2021

Appointed Sam Kang as President, reached granting milestone, and launched the Giving Guide

Kim Laughton retires as President and Sam Kang is appointed to the role. Grants to charities since inception also surpass $20 billion and the Giving Guide launches to help donors develop strategic giving plans. -

2022

Evolved relationship management model and eliminated $100 minimum administrative fee

The Business Development team shifts its focus to assisting with new accounts, and a Charitable Consulting team is formed to assist with existing accounts. The $100 minimum administrative fee is also eliminated to help donors with lower-balance accounts. -

2023

Reduced minimum for PMAs and launched family philanthropy resources

The professionally managed account (PMA) minimum balance is lowered from $250,000 to $100,000. A comprehensive collection of family philanthropy resources is also produced in collaboration with the National Center for Family Philanthropy. -

2024

Organization celebrates 25 years of donor-advised giving with new brand

In concert with our 25th anniversary, we announce we will move forward as DAFgiving360™ and will use our brand to elevate the donor-advised fund category and awareness of its DAF solutions.